Why Do This

Social media investigation is the new surveillance being used by insurers and defense counsel – you can no longer ignore your client’s social media activities

The Landscape has Changed and You Need to Adapt

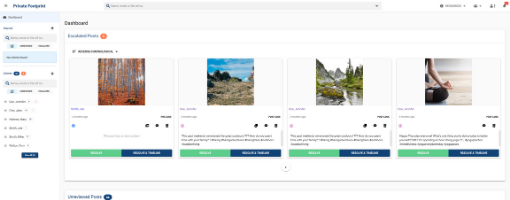

Be informed, reduce risk, and leverage the power of client social media content to increase the value of their file.

✔ Get ahead and avoid the Deposition/Discovery Surprise.

✔ Notice issues early that may decrease the value of your file.

✔ Pre-date-of-loss reports help you increase your settlement value.

✔ Your clerks and support staff will save hours building reports.

✔ Easy to make part of your retainer agreement for every client.

✔ A one-time disbursement which costs less than a clinical note.

Six Reasons Why Social Monitoring Has Become Critical

1. Surveillance has Moved Online

Not long ago, you worried mostly about physical surveillance of your clients’ activities. Today, it’s all on social media and insurers (and other opposing counsel) are working hard to uncover your clients’ online profiles in order to invalidate their claim.

2. Changing Client Behaviors is Hard

Clients recovering from an accident or illness will often deny their social media usage to their lawyer because it is one of their few remaining outlets. But their posts can be misrepresented by opposing counsel and difficult to explain to a jury, thereby hurting their case.

3. You’re Leaving Money on the Table

Painting a picture of your client’s life before their injury or illness helps you build a stronger case. By using pre-date-of-loss social history, you can build a compelling report in minutes that can help increase settlement values.

4. Settle Faster. Settle Smarter

Ongoing monitoring helps you notice issues that may decrease the value of your file. Get ahead of the curve and avoid the Discovery Surprise. If you see problems early, it may even encourage you to settle faster and for a better overall outcome.

5. Don’t Take on Unnecessary Risk

Prospective clients may tell you one story, but their social history tells another. By the time you first meet them, the damage may have already been done. Quickly run a report of their social accounts to assess if they are indeed a file you want to take on.

6. Your Clients Are Not Good at This

You ask your clients to bring you pictures, videos and items to show how their lifestyle was before the accident. Often the information is disorganized and selectively chosen, leading to missing information. Instead, pull their entire social media history in an instant and find years of potential information.